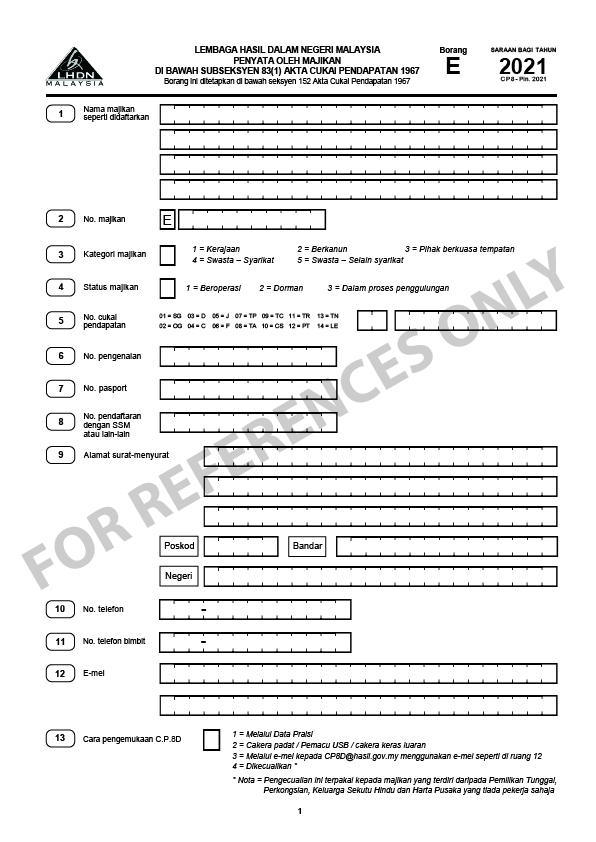

At Declaration screen you are able to. Every employer shall for each year furnish to the Director General a.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

What If You Fail To Submit Borang E and CP8D.

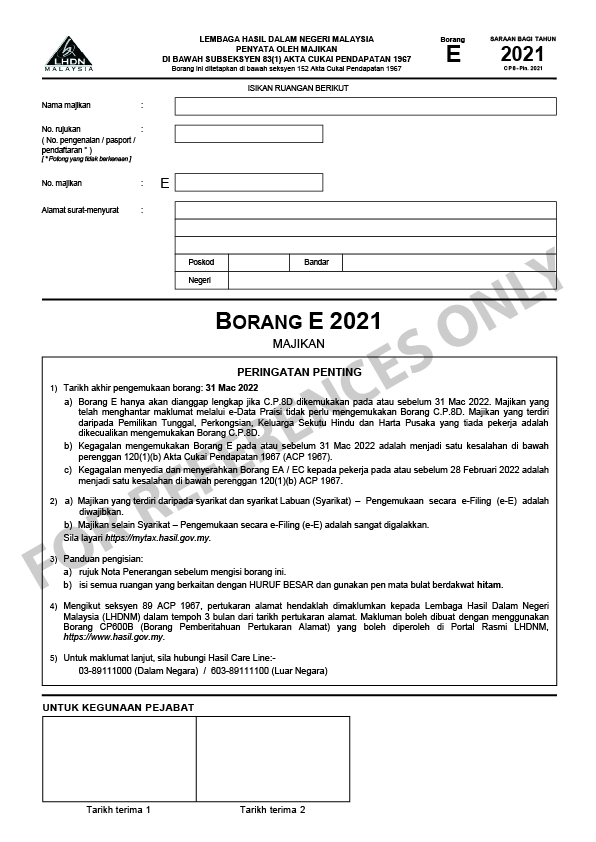

. I went there they wanted me to write an. Submit Employers Return Forms Borang E example E-2018 by 31st March every year even you dont have any employees starting from the following year of LLP registration. Every company needs to submit Form E according to the Income Tax Act 1967 Akta 53.

Mandatory E-Filing staring next year. Employers may still submit Form E manually to IRB this year for Year of Assessment 2015 submission. Untuk video kali ini adalah perkongsian mengenai panduan mengisi borang e-filing untuk cukai penda.

What is Borang E Form E. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran. Sign and Submit button To submit form.

Print Form Draft button Print form in PDF format. If you are filing the E form online the pdf file is for your information only to help you fill the details in the online form. A minimum fine of RM200 will be imposed by IRB for failure to prepare.

The letter should contain the following details. QUOTE brownbunny Mar 31 2014 0434 PM save and submit. Form E is an employee income declaration report that employers have to submit every year.

The CP8D txt file will need to be uploaded during online filing of the E form. Send Letter to KWSP. Prepare a letter and fax it to KWSP contact centre at 03-89226222.

However employers are mandatory to furnish Form. Wuahahahhahahaha my rookie mistake last time. Cukai efiling lhdn Assalamualaikum dan salam sejahtera.

The Borang E must be submitted by the 31st of march of every year. Failure to do so will result in the IRB taking legal action against the companys director. Go to ezHasil enter your NRIC number and password.

Form E submission process. Continue button to submit your e-Form. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors.

Once you have downloaded the PDF format for Form E you will need log in to ezHasil portal to submit Form E. Click First Time Login if its your first time and insert the PUN and IC number to. Kindly note that Fine of at least RM200 will be imposed.

Once logged in head to Services e-Filing and select e-Form.

How To Step By Step Income Tax E Filing Guide Imoney

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Submit Form E With Swingvy Malaysia Youtube

How To Step By Step Income Tax E Filing Guide Imoney

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

How To Re Submit Your Income Tax Form If You Did It Wrong Malaysia Financial Blogger Ideas For Financial Freedom

How To Easily Prepare Borang E Ea E Data Praisi And Otosection

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

Ezhasil E Filing Login Account Pin Number Digital Certificate Application For Organization The Research Files

How To Use Lhdn E Filing Platform To File Borang E To Lhdn Clpc Group

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News